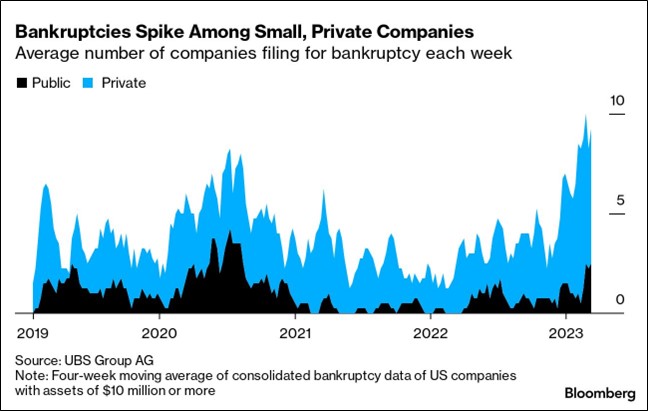

How Digital Sales Channels Disrupt SME Sales in Distribution and Services

The entrepreneurial spirit, a cornerstone of the global economy, has traditionally thrived on personal relationships, handshakes and a keen understanding of local markets. But the tide is turning. A digital tsunami is reshaping the way businesses, particularly small and medium-sized enterprises (SMEs), connect with customers and drive sales. The digitization of sales channels is massively […]

Read more