DACH Mittelstand: Investment Considerations and Valuation Multiples

The DACH region (Germany, Austria, and Switzerland) is known for its robust economy and strong industries. One important feature of this region’s economy is the prevalence of small and medium-sized enterprises (SMEs), also known as Mittelstand. These companies are critical to the region’s economic growth, as they account for the majority of employment and GDP in the area. As a result, investing in these companies is of great importance, not only for the investors but for the region’s economy as a whole.

Mittelstand Landscape in the DACH Region

The term Mittelstand refers to small and medium-sized companies in the DACH region with revenues ranging from a few million euros to a few hundred million euros. These companies are often family-owned or managed with a long-term focus on growth and profitability. The Mittelstand landscape in the DACH region is vast, comprising over 3 million companies, and they employ around two-thirds of the workforce.

Mittelstand companies in the DACH region are known for their high-quality products, technological innovation and excellent customer service. These companies are also highly specialsed and dominate specific niche markets, which gives them a competitive advantage. For example, German Mittelstand companies are known for their engineering expertise, which allows them to provide high-tech products and services to various industries.

Challenges faced by Mittelstand companies

Despite Mittelstand’s strengths, these companies face several challenges that can hinder their growth and profitability. One significant challenge these days is access to capital, as many Mittelstand companies have limited financial resources. These companies often rely on bank loans or internal financing, which at current interest rates, can limit their ability to invest in research and development, expand operations or acquire new companies.

Another challenge is the lack of digitalisation, as many Mittelstand companies have not fully adopted digital technologies. This can limit their ability to compete with larger companies and reduce their efficiency and productivity. Additionally, many Mittelstand companies struggle with succession planning, as they are often family-owned or managed. Finding a suitable successor can be challenging, particularly if the family members are not interested in taking over the business.

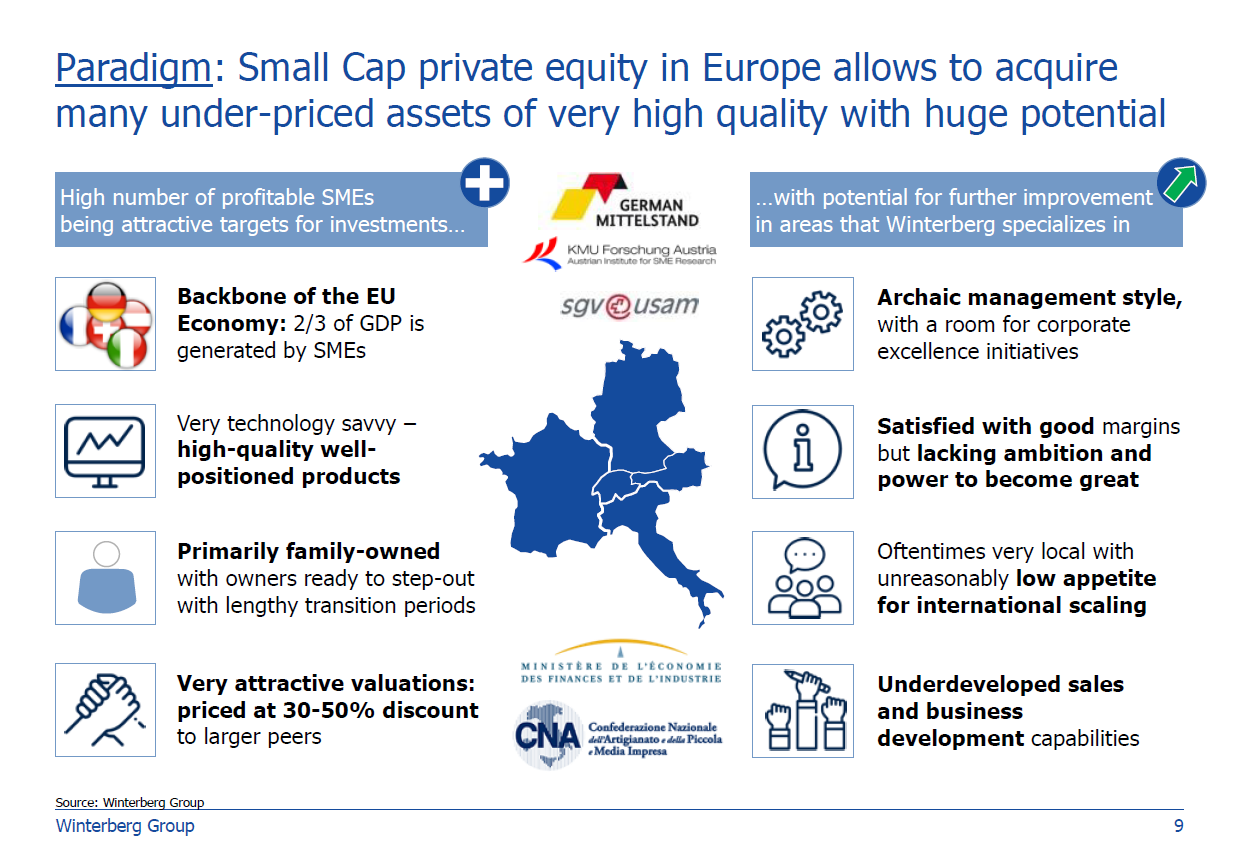

Investing in Mittelstand

Investing in Mittelstand offers several benefits. Firstly, these companies are often stable and profitable and have a long-term focus, therefore resulting in high visibility on potential returns. Secondly, despite each individual company’s strength, there are usually many inefficiencies that can be solved by merging similarly-sized companies across the value chain. Thirdly, SMEs tend to be traded at a discount (so-called size discount to larger peers), therefore offering better returns with the same fundamentals.

However, investing in Mittelstand companies also comes with risks. These companies are usually highly specialised and have sophisticated products or service offerings, therefore requiring the owner’s presence and involvement in daily operations. Sometimes, when we at Winterberg look at Mittelstand targets, we can’t see the business post-acquisition without the selling shareholder. In combination with Seller’s age, this can be problematic, as it is sometimes impossible to motivate 70-year-old owners, who have been working for their family business for dozens of years, to perform at 150% of their capacity once they have cashed out. The majority of selling shareholders don’t want to be operationally involved after the sale, which raises the chicken and egg problem for us and usually results in a failed deal.

Valuation Multiples

When we talk about Mittelstand valuations, in Q1 2023, based on the processes we are involved in, we see the overall range of 4x – 8x EBIT as the basic case for Enterprise Value. With such a range, the sellers may have more than a 2x difference in the purchase price, so we thought that it would be insightful for sellers to learn which major factors influence the valuations.

Industry and Market Conditions

Specific industry and market conditions can have a significant impact on a company’s valuation multiple. Companies in high-growth industries such as technology or healthcare often have higher valuation multiples compared to companies in slow-growth industries like industrials. As with any other product, the market conditions, such as supply and demand, also affect the valuation multiples. If there are many buyers and few sellers in a specific industry, the valuation multiples may be higher.

Growth and Profitability

Small-sized companies with strong growth prospects and profitability often have higher valuation multiples. Investors are willing to pay a premium for companies with high growth potential, as they expect to earn higher returns in the future. Companies with a track record of generating strong profits and cash flows can also attract higher valuation multiples.

Size and Scale

The size and scale of a small-sized company can impact its valuation multiples. Smaller companies may have lower valuation multiples due to higher risks and uncertainty compared to larger companies. As companies grow and achieve scale, they may benefit from economies of scale, which can lead to higher profitability and cash flows, resulting in higher valuation multiples.

Business Model

A particular company’s business model also affects its valuation. Project-based revenue, high customer concentration, high supplier concentration, vulnerable value chain position, high working capital requirements and high capital intensity – these factors lower the valuation multiple as they are associated with higher risks.

Management and Leadership

The quality of management and leadership can also impact the valuation multiples of small-sized companies. We prefer to invest in companies with competent and experienced management teams, who have a track record of successfully growing and managing businesses. Companies with strong management and leadership teams that are not dependent on the selling shareholders may have higher valuation multiples due to the reduced risk of investment.

Deal Structure and Risk Sharing

Risk-sharing mechanisms in the forms of earn-outs, re-participation, vendor loans and the like, which drags the selling shareholders to participate in the company’s future usually increase the overall valuation of the company, as part of the purchase price is deferred in nature.

Country risk

While DACH is usually considered a homogenous region, it is not like this when it comes to valuations. Before Credit Suisse’s merger with UBS was announced, it was visible, that German SMEs had a discount compared to Swiss SMEs, while Austrian SMEs had a small discount on German SMEs. We are yet to see where the dynamics post-CS deal will lead the markets.

Winterberg Group investments in Mittelstand

At Winterberg, we focus on Mittelstand investments since 2017. Following successful deals in different sectors, we are on the watch for players with EBITDA in the range of 1-5 million EUR with a strong product and services portfolio, experienced management and robust market position.

“There are many specialised players within the DACH Mittelstand that contribute to addressing major problems of the future. Mittelstand’s unique features allow us not only to achieve attractive returns but also to make a positive impact on our society and environment.”

Fabian Kröher, Executive Director at Winterberg Group